Mobikwik App Se Loan Kaise Le: If you are in great need of money, and are not able to arrange the money from here and there, then in such a situation you can take a loan using the Mobikwik App. If you are using a smartphone and are using Mobikwik App on that phone and you suddenly need money, then in such a situation you do not need to wander here and there.

Mobikwik Application provides the facility to the public that by using Mobikwik Application, they can easily get a loan from Mobikwik Apps and too within just 5 minutes, hence we will tell you in full detail in this article how to take a loan from Mobikwik. I will provide complete information about it. By reading this article till the end, you will be able to get complete details about Mobikwik Se Loan Kaise Le in a very easy process.

Advertisement

Also, before proceeding further in this article, let us tell you that to apply for a loan online with the help of this app, you will have to keep a PAN card, Aadhar card, bank passbook, and other information available with you. So that when you apply online, you will not face any kind of problem or trouble.

Mobikwik Loan App Overview

| Name Of Article | How to take a loan from Mobikwik |

| Type of Article | Latest Update |

| Name of the App | Mobikwik App |

| Apply Mode | Online |

| Type of Loan | Personal Loan |

| Who Can Apply? | All Mobikwik Users |

| Charges of Application | As Per Applicable |

| Loan Amount | ₹5000 Up to 1 Lac |

| Official Website | https://www.mobikwik.com/ |

Mobikwik Loan App Features and Benefits:-

Mobile Wallet

Mobikwik is a mobile wallet in which consumers can keep their money and use it for various financial transaction activities.

Mobikwik Wallet Recharge & Bill Payment

Through Mobikwik, consumers can easily pay their mobile, DTH, gas electricity bills etc.

Mobikwik Online Shopping

Consumers can also use Mobikwik to make purchases on online shopping sites and pay for them from their mobile wallets.

Credit and debit card transactions

Through Mobikwik, consumers can make credit and debit card transactions from their bank accounts.

MobiKwik Zip Online Loan

Some of the financial services offered by Mobikwik include online loans, which can help consumers easily get the money they need.

Mobikwik Cashback Offers

Mobikwik offers cashback and offers on various transaction actions, allowing consumers to save even more on their purchases.

Take an instant loan at 0% from the Mobikwik App, know the application process

We would like to heartily congratulate all the dear readers and youth who read this article. If you use a MobiKwik application and you need money, then in such a situation you do not need to go anywhere. You can get a loan through some applications. Currently, loans ranging from Rs 10,000 to Rs 100,000 are being given to the youth through Mobikwik Application. The complete process of applying along with its detailed information is shared in this article.

You can know its complete process by reading this article till the end. However, Movie Quick is giving loans ranging from Rs 5000 to Rs 100,000 to the users. You can fulfill your needs by taking a loan from Movie Quick App, further in this article, you will know how to get a loan through Movie Quick App and how you have to apply. Detailed information on how to apply is given along with its complete information.

Do Read:

CashBean Loan App Download – Cashbean Loan app Review

What is Mobikwik Zip EMI?

lets you split your loan as per your financial needs, allowing you to pay at your convenience.

Mobikwik Zip is a financial service that helps consumers get loans easily. It is a kind of digital credit that can be used for various purchases and transaction actions.

1. Quick Loan Approval

Mobikwik Zip helps you get instant loan approval, so you can get the money you need without delay.

2. Credit Line

Through this, you are provided a credit line, which you can use as per your needs.

3. Use without interest

When you make purchases using Mobikwik Zip, you do not need to pay interest for a period of time.

4. Various options

It offers you financial plans with different options, allowing you to pay at your convenience.

5. Online Shopping

Mobikwik Zip can be used for online shopping, allowing you to purchase various items and services easily.

6. Rational interest rates

When using your line of credit, you get reasonable interest rates that fit your financial situation.

Some key features of Mobikwik Zip EMI

- To get approved for the Mobikwik Zip EMI Loan, you have to apply online.

- The application process is usually fast, and you can buy immediately once approved.

Uses of Mobikwik Zip EMI

- Mobikwik Zip EMI can be done with multiple online sellers and service providers, allowing you to purchase your selected products or services.

- You will have to pay a large amount for EMI along with initial charges and interest,

- However, it does provide financial facilities that can help people approve expensive purchases.

- You are required to provide your personal identification and some basic documents, but you do not need supplies.

Required Documents

If you want to know how to take a loan from Mobikwik and the documents required for application, then read the information given in this article. How to take a loan from Mobikwik i.e. required documents are as follows-

- Aadhar card

- PAN card

- bank passbook details

- Mobikwik registered mobile number

- Email ID and other information

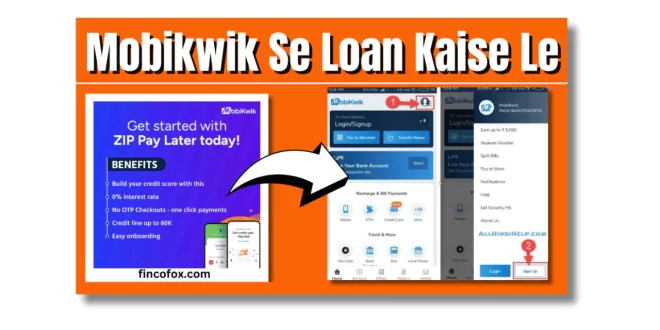

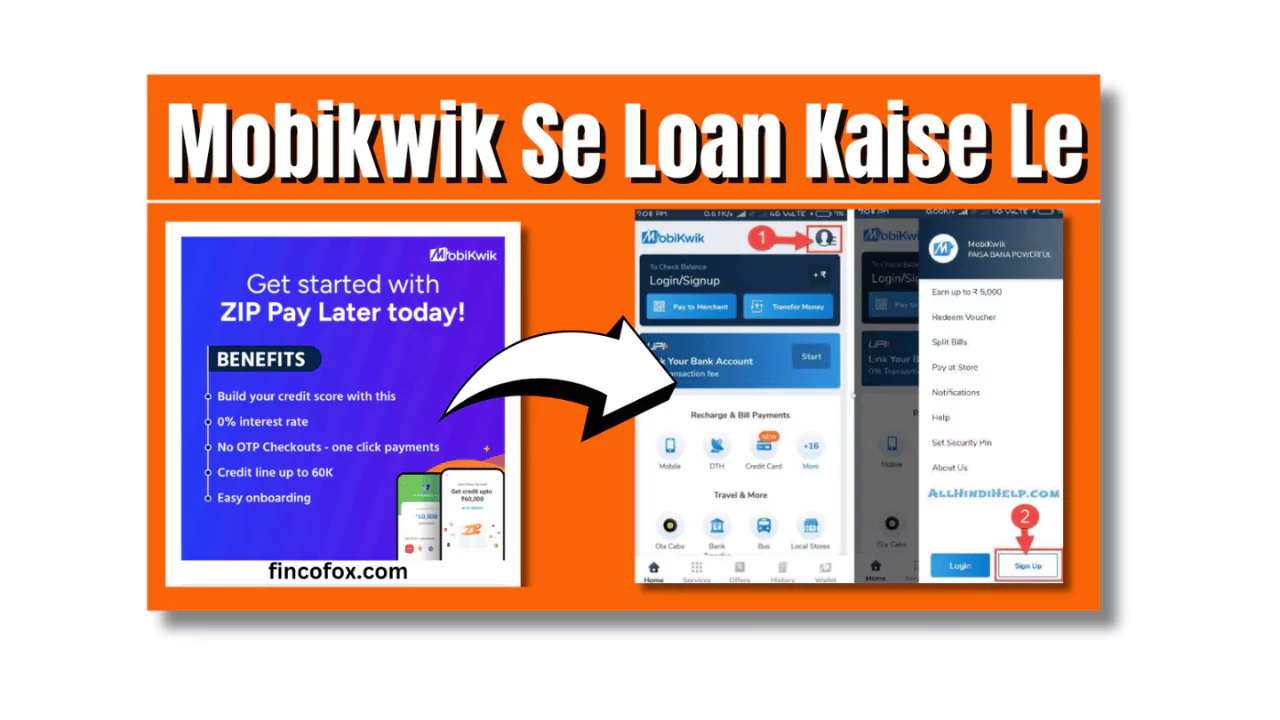

Mobikwik App Se Loan Kaise Le (Step By Step):-

If you want to know its online application process then follow the process given below step by step. How to take a loan from Mobikwik? The application process is as follows-

- First of all, open the Play Store application on your phone.

- Now you can search Mobikwik Application by clicking on the search button.

- Now download and install the Mobikwik Application on your phone.

- After installation, you can log in to Mobikwik Application with some information.

- After logging in to the Mobikwik Application, you will get to see the dashboard like this-

- Now click on the ZIP option below

- After clicking on the Zip option, you will see the Get Start option, click on it.

- After clicking, your credit score will now be shown, and wait for some time.

- Now click on the I Accept option.

- After clicking, now enter your account number and click on the Continue option.

- Now you create NACH, click on the Know More About NACH option to create NACH.

- Now you can verify your account as NACH with the help of your account number or ATM card number.

- After verification, your loan amount through Mobikwik Application will be credited to your Mobikwik App.

- Now you come back to the dashboard of the Mobikwik Application.

- Now click on the EMI Loan option.

- After clicking, now click on the Withdraw to Bank option.

- Now select the loan amount as per your requirement.

- After that click on the Continue option

- Now set the EMI as per your choice and click on the Select to Continue option.

- After clicking, carefully check all the information related to your people, which will be like this-

- Now click on the Proceed to Withdraw option

- After clicking, the loan amount will be successfully transferred to your account.

By reading the information given above, you can take a loan from Mobikwik App through a very simple process.

Summary

In this article, we have given all of you detailed information about it. By reading the article till the end, you can learn the process of taking a loan from the Mobikwik App in a very simple process.

Now you can get a loan of up to ₹ 100,000 from the Mobikwik Application with a very easy process. To take a loan, you will have to apply online. Detailed information about how to apply online is shared in this article.

Friends, I hope that all of you have read this article to the end and you would have liked this article very much, for you will definitely like, share, and comment on our article.

FAQs – Mobikwik App Se Loan Kaise Le

Up to what extent can a loan be availed from Mobikwik?

Loans ranging from ₹ 9000 to ₹ 100000 can be availed through the Mobikwik application, for which you will have to apply online. Detailed information about how to apply online has been shared in this article, you can read it carefully to know the complete process of applying.

How to pay Mobikwik Loan EMI online?

To pay Mobikwik Loan EMI, first, open the Mobikwik application, then click on the Loan option, now select the EMI amount as per your requirement. Now finally make the online payment through UPI, Debit Card, Internet Banking, etc.

Finco Fox Best Finco Blog

Finco Fox Best Finco Blog