Navi Loan App Se Loan Kaise Le: Navi Personal Loan App is a financial service-providing application. Apart from providing the service of personal loans and home loans, this app also provides the service of investment. If you are looking for a personal loan or a home loan or thinking of investing in mutual funds and gold, then the Navi app for you could be a good option.

Advertisement

This app is recognized by RBI and fully follows all the rules set by the government for investment. Today in this article we will mainly understand the personal loans offered by Navi App in complete detail.

Advertisement

Navi Personal Loan Kya hai?

Nowadays, if you try to take a loan through a bank, you spend a lot of time in the documentation and running around for the loan. In such a situation, Navi Loan App provides instant personal loans up to Rs 20 lakh. Through this app, you can complete the loan application in just a few minutes.

After completion of the loan application, the loan money is transferred to your account within a few minutes.

Advertisement

Do Read:-

- Shriram Finance Personal Loan Apply Online

- RBI Registered Loan App List Pdf 2024

- CashBean Loan App Download

Navi Loan App Review 2024:-

- Navi Loan App is an Indian NBFC-registered company.

- The loan given through this app is given through Navi Finserv Limited.

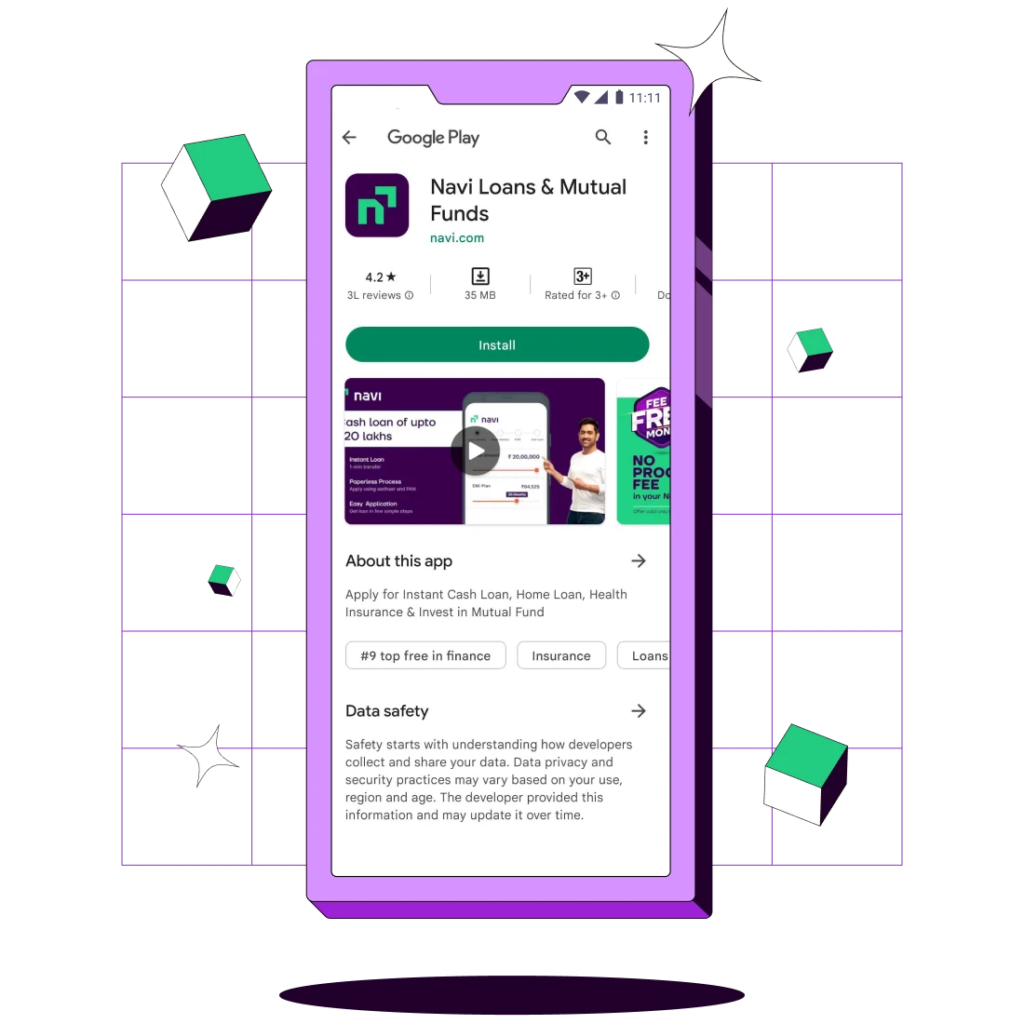

- This app has a rating of 4.3 on Play Store and its number of downloads is more than 50 million.

- This app provides many types of financial services like personal loans, home loans, mutual funds, gold loans, insurance policies, UPIs, and many more.

- You can earn up to ₹ 15000 per month by referring to this app.

- This app currently gives ₹100 as a reward for each referral which you can transfer to your bank account through UPI.

Navi app Personal Loan interest rate and other charges:-

At present the minimum interest rate prescribed for Navi Personal Loan is 9.9% and the maximum interest rate is 45%.

Processing Fee: Nil

Advertisement

Apart from this, EMI bounce fee, loan for closure fee, late payment fee, and some other charges have to be paid as per the situation, the information of which is not shared by Navi Loan App.

Therefore, while taking a loan, read the agreement carefully and get information about these charges.

Features of Navi Personal Loan:-

- If you qualify, the loan money is transferred to your bank account within a few minutes.

- The process of taking a loan is completely online. You do not have to submit any physical document of any kind.

- To take a loan you only need a PAN card and an Aadhar card.

- Navi Personal Loan is an unsecured loan and here you do not have to provide any collateral security.

- As per your wish, you can apply from here for a loan ranging from the smallest loan amount to the largest i.e. up to Rs 20 lakh.

- This app follows the rules of RBI. It is a registered NBFC company.

Documents required for Navi Personal Loan:-

Various types of documents are required to avail Navi Personal Loan. If you have heard about taking a personal loan through an Aadhar card, then for that you have to submit at least an Aadhar card and PAN card.

Similarly, to take a loan from this application, you require at least these documents. These are all the documents we require –

- Aadhar Card – To take a loan through this application, first of all, we need Aadhar Card. Without an Aadhaar card, taking a loan from this application can be a bit difficult.

- PAN Card – Apart from the Aadhar Card, a PAN Card is also required. A PAN card is also most important to take an online loan from this type of application. If you are wondering how to take a Navi personal loan? So after this, you do not need to worry because you can take a loan from this application.

- Bank Information – Apart from the two documents mentioned above, bank information also has to be given in it. As soon as your loan is approved, the loan amount is sent to your bank account.

- Income and Expenditure Information – Apart from the above documents, you also have to provide at least information about your earnings. Any financial institution that gives you a loan asks you about your earnings so that it can estimate whether you will be able to repay the loan on time or not.

These are all the important documents that we need first so that we can take a loan from this Navi Loan application. Apart from this, there are some processes for this which are explained further.

Advertisement

Navi Loan App Customer Care Number:-

Before taking a loan from the Navi Loan App or after taking the loan, you may need to talk to customer care. At present there are two ways available to contact the Navi App-

- Email ID: hello@navi.com

- Chat support facility

- Phone call facility is not available.

Navi Loan app se Loan Kaise le (2024)?

To take a personal loan from Navi Loan App, follow the following steps-

Advertisement

Step 1 – First download the Navi app from the Play Store.

Advertisement

Advertisement

Step 2 – After that, accept the Navi app’s terms and conditions, click on continue, and allow whatever permission is asked.

Step 3 – Then you will be asked to enter your number, enter your number, and click on Get OTP and verify OTP.

Advertisement

Step 4 – After this, your account will be created in the Navi app and you will come to the home page. Now here you will see 2 columns of personal loan and home loan. Apply for a Navi personal loan and home loan.

Step 5 – Whatever loan you want to take, click on it, after the Navi app asks you for some personal details like –

Advertisement

- Your name is on the PAN card.

- Your Marital Status.

- Employment Type means whether you are a salaried person, unemployed, student, or retired.

- Your Monthly Income.

- In which company do you work?

- Reason for taking a loan.

- What is your minimum education qualification?

- Your PAN card number.

- Enter your date of birth which is on your PAN card.

- 6-digit PIN code of the place where you live.

After filling in all these details you have to click on apply.

Step 6 – After this, it will take 2 to 3 minutes for your application to be processed, if you are eligible to take the loan, then you complete the further process and if your application is rejected, then you can apply again for 90 days. You can apply from. Now you can apply for a loan

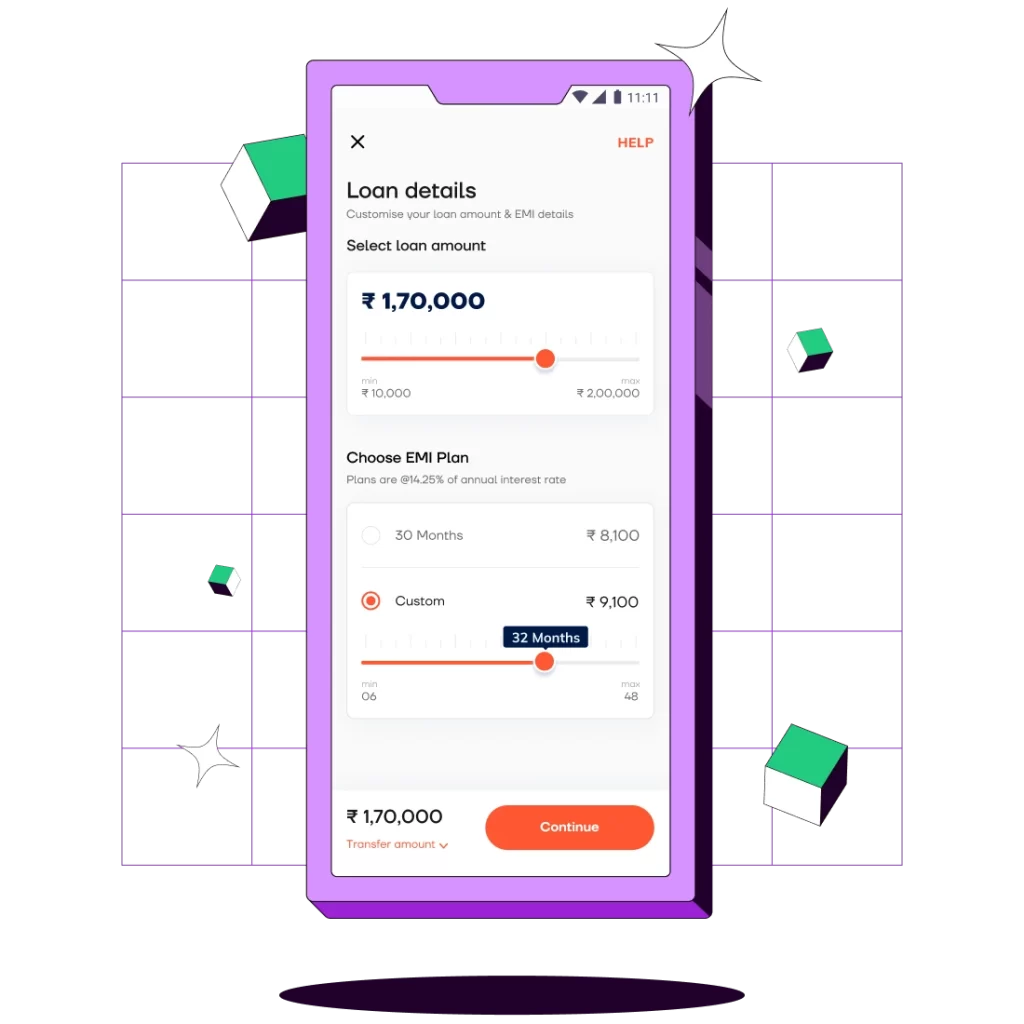

Step 7 – Once the loan is eligible, you will have to select the loan amount and monthly installment.

Step 8 – After this complete your KYC, for this you will need an Aadhar card and a selfie.

Step 9 – Fill the details of the bank account in which you want money. Keep in mind that you have to give details of only that bank account which is currently working.

Now the loan amount will come to your account within some time. So this was the easy process by following which you can apply for the loan on the Navi app.

Benefits of Navi personal loan

- You can take a personal loan up to Rs 20 lakh from the Navi app.

- No bank statement or salary slip is required to take a personal loan from the Navi app.

- You do not need any paperwork for a Navi loan.

- You do not need any kind of collateral. This means that while taking a personal loan from Navi, you do not need to mortgage any kind of property.

- Minimum documents are required.

- When you apply for a Navi personal loan, your eligibility is checked to see whether you can take the loan from the Navi app or not.

- If you are eligible to take a loan from the Navi app, the loan amount is immediately transferred to your bank account.

- Navi app provides loans in big cities of almost all the states of India.

Conclusion (Navi Loan App Se Loan Kaise Le 2024)

So, friends, this is how you can take a loan from the Navi App. I sincerely hope that you would have liked this article.

I hope you have learned how to take a loan from Navi App from this post. If you still feel that some improvements need to be made in this post, then you can tell us by commenting.

Also, if you liked this post, then share it with all your social media accounts and friends.

Thank you!

FAQs:- Navi Loan App Se Loan Kaise Le

How many types of loans does the Navi app provide?

Navi app provides home loans and personal loans.

How much loan can I get from Navi loan?

You can get a loan of up to Rs 20 lakh from Navi loan.

What is the interest rate on Navi’s loan?

The interest rate charged on a Navi personal loan depends on various factors like loan amount, repayment tenure, and credit score. The interest rate can range from 9.9% to 45%.

What is the repayment tenure for Navi’s loan?

The repayment turnover for a Navi personal loan can be from 3 to 72 months so that you can choose the repayment turnover according to your financial situation.

What are the eligibility criteria for Navi’s loan?

The eligibility criteria for a Navi personal loan depends on your age, income, employment status, credit score, and some other factors. You can know your eligibility by using Navi’s online loan calculator.

Finco Fox Apply Loan Here

Finco Fox Apply Loan Here